Italy Offers Tax Free Haven for Wealthy Britons Seeking Brexit Escape

In an attempt to entice wealthy individuals to part with their cash on the Italian peninsular, Italy is set to introduce a set of measures which will allow expats to become residents whilst paying no tax on foreign income for 15 years.

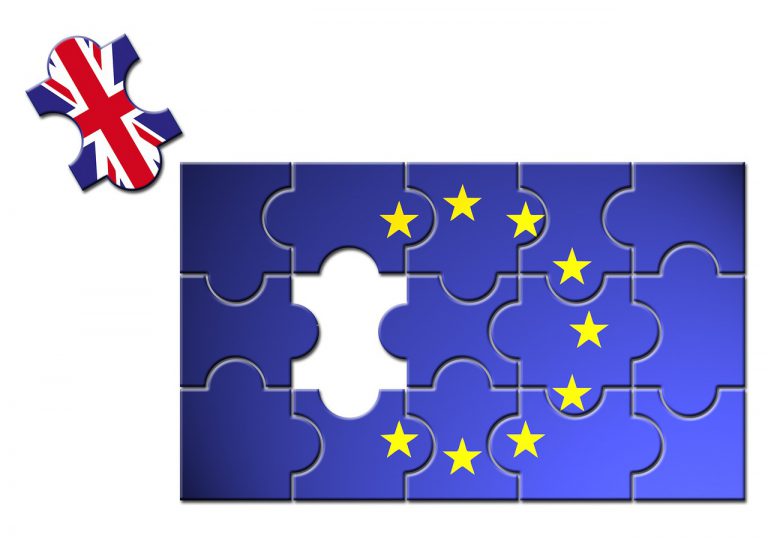

It is a move designed to entice disenfranchised Britons seeking to escape from Britain over fears of a damaging “hard Brexit”. However, Italy has put in place strict conditions which must be met which means the proposal may apply to only a small pool of British expats.

Applicants must have resided outside Italy for the previous nine years, and must be earning considerable foreign income. The residency all comes with an annual fee of 100,000 euros, and a requirement to purchase and reside in an Italian property for at least 6 months per year.

The move is designed to bring the spending power of wealthy individuals into Italy, and with the safeguards in place aims to attract those seeking a second home, or alternate residency, as opposed to attracting a mass influx of expats who would seek tax breaks around domestic income earned, and lower charges for residency.

Italy’s move follows similar overtures from Portugal, whose offer includes the abolition of a 1% tax on property valued at 1 million Euros or higher. Expats would be able to spend up to 600,000 Euros each on a property without paying the levy.

Should you wish to assess your investment needs or portfolio please contact us, or alternatively schedule a free, no obligation, consultation, with one of our Financial Advisors here.

Disclaimer: Any information or related news item displayed on this site is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed or as advice in anyway and all users should seek independent advice before relying on any information or comment expressed within the site. All expressions of opinion reflect the views of their respective authors as of the date of publication and are subject to change. Use of Links (hyperlinks) to or from other internet sites may be included at times for the convenience of the user. Synergi Europe and its affiliates assume no responsibility for the content of any linked site. The fact that such links may exist does not indicate approval or endorsement of any material contained on any linked site.